In recent years, the natural and organics category has seen significant growth, but the profiles and motives of today’s natural/organics shoppers are drastically different than they were less than a decade ago. The latest Hot Topic Report, Back to Our Roots: The Rise of the Natural/Organic Shopper, from Acosta — a full-service sales and marketing agency in the consumer packaged goods (CPG) industry — explores modern-day natural/organic shoppers, including what they’re buying and from where, why they purchase these foods, and how they get information about the products’ ingredients and processes.

“Not so long ago, shoppers interested in natural and organic food had to seek out specialty stores to find the items they wanted,” said Colin Stewart, Senior Vice President at Acosta. “Now, not only has the growing popularity of non- or minimally processed food fed the rise of major specialty retailers, it is also transforming product development and grocery retail across various channels as the profiles of natural and organic shoppers evolve.”

Acosta’s Back to Our Roots: The Rise of the Organic Shopper report takes an in-depth look at these shopper profiles, highlighting:

Who are natural/organic shoppers?

It’s not surprising that Millennials are helping to drive the natural/organic trend, but GenXers and families also play a large role.

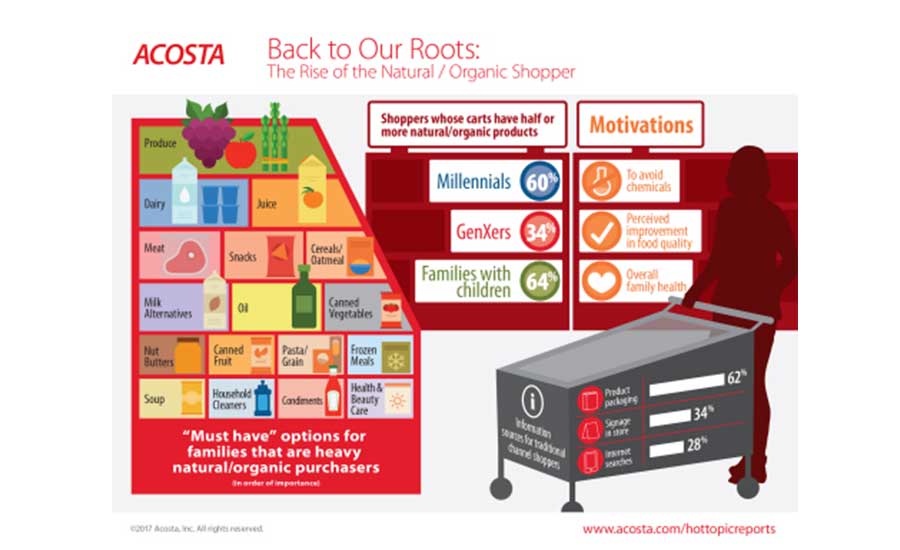

• Millennials purchase natural/organic food most frequently, with on average 60% of their food baskets containing half or more natural/organic products.

• GenXers are second to Millennials with 34% of their purchases consisting of natural/organic products.

• Of shoppers with baskets that contain 50% or more natural/organic items, 64% have children, compared to only 36% for households with no children.

What are natural/organic shoppers buying?

Shoppers are seeking natural/organic products in categories with an increased penetration rate, including dairy, cereal/oatmeal, snacks, pasta/grains and soup.

• “Must have” natural/organic items for families that are heavy purchasers of these items include produce (60%), dairy (50%), juice (47%), meat (46%) and snacks (44%).

• Natural/organic health and beauty care items and condiments are “must haves” for only 33% of families that are heavy purchasers of natural/organic items.

• Beyond their interest in natural/organic products, more than 70% of Millennials are willing to spend more on products like juices, oils and nut butters, demonstrating how the category can impact center store sales.

Where do natural/organic shoppers shop?

Each generation of natural/organic shoppers has its own preference of where to shop for these items.

• Silents (55%), Boomers (54%) and GenXers (42%) most frequently shop for natural/organic products at traditional grocery stores, primarily due to the convenience factor.

• Approximately 20% of Millennials shop for natural/organic products at traditional grocery stores, too, but nearly 30% gravitate to the value channel for better pricing, product variety and ‘shopability.’

• Thirty% of shoppers with families purchase natural/organic products most often in the value channel, seeking lower price points.

Why are shoppers choosing or not choosing natural/organic products?

There are several factors that influence natural/organic shoppers’ decisions to buy these products, but also several barriers that inhibit purchases.

• The three key triggers motivating shoppers to fill their carts with natural/organic products include avoiding chemicals found in traditional food; a perceived improvement in food quality; and overall family health.

• For traditional retailer shoppers (74%), mass retailer shoppers (63%) and natural retailer shoppers (61%), price is the biggest barrier to purchasing natural/organic items.

• For 19% of natural retailer shoppers, there are no barriers for purchasing natural/organic products.

How are shoppers learning about the natural/organic products they buy?

While price is a primary barrier for natural/organic shoppers, the runner-up across channels is “conflicting information or studies about products,” as shoppers are confused about exactly what is good for them.

• Fifty-six to 63% of natural/organic shoppers report they read labels for product information.

• The top three sources of product information for natural/organic shoppers are product packaging, in-store signage and internet searches.

• Nearly 73% of Millennials claim spending time researching while in the midst of a spending decision.