In late 2012, Information Resources Inc. (IRI) predicted that private label in the U.S. had hit a proverbial glass ceiling. This prediction has proven true, at least at the macro level, according to a new report, IRI Times & Trends’ “Private Label and National Brands: Paving the Path for Growth Together.”

In late 2012, Information Resources Inc. (IRI) predicted that private label in the U.S. had hit a proverbial glass ceiling. This prediction has proven true, at least at the macro level, according to a new report, IRI Times & Trends’ “Private Label and National Brands: Paving the Path for Growth Together.”

Researchers say both private label and national brands’ shares of sales remained unchanged during the past year, with private label share of dollar sales inching up slightly--largely due to above-average price inflation within the private label sector. But, the report goes on to illustrate that consumers’ “new normal” puts value in the crosshairs of every purchase decision and paves new roads of opportunity for private label and national brand CPG marketers.

“While some industry experts believe private label has ‘had its day,’ IRI believes that private label and national brand marketers can enjoy mutual growth by not simply co-existing, but rather evolving and working together to serve the full spectrum of consumers’ needs and wants,” says Susan Viamari, editor of Times & Trends, IRI. “Of course, consumers are shopping conservatively and looking for money-saving options, so they have embraced private label. However, national brands remain critical. In this environment, manufacturers and retailers must work together to provide a balanced assortment of national and private label solutions, targeted at the store level, to offer the best over-arching value.”

Channel Trends

Private label share is highest in the grocery channel, at 21.9% of unit sales and 18.2% of dollar sales. Grocery also enjoys the strongest level of private label penetration, by far, at 96.9%. Despite the fact that the private label landscape has become more crowded and more competitive, grocers have done a commendable job of protecting share.

Private label share is highest in the grocery channel, at 21.9% of unit sales and 18.2% of dollar sales. Grocery also enjoys the strongest level of private label penetration, by far, at 96.9%. Despite the fact that the private label landscape has become more crowded and more competitive, grocers have done a commendable job of protecting share.

In addition, private label performance within the drug channel has been quite strong during the last year. Unit share grew one full point, to 17.6%, while dollar share climbed less sharply, to 16.9%. Though private label share inched up slightly in the convenience channel during the same time period, it remains well below industry average, at 2.4 and 1.7%, respectively. Private label’s strength across the drug and convenience channels is attributable to a number of factors, including retailer efforts to broaden and enhance private label programs.

The club channel is demonstrating the strongest private label share growth -- growth that is occurring across both heavy and light purchasers of private label products. This growth brought the channel nearly $1.4 billion more in private label sales from heavy and light buyers in 2013 compared with 2010.

Category Trends

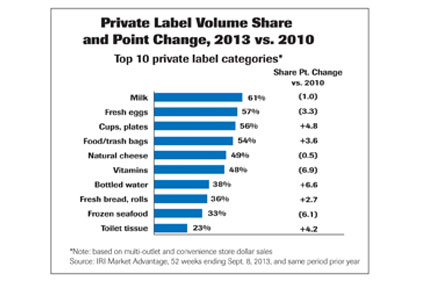

Private label share of volume increased across five of the 10 largest private label categories during the past three years. These categories (see chart) are viewed as “staple” categories, since consumers tend to see little differentiation between private label and national brand options in these categories. Combined, share victories brought more than $2.6 billion to private label marketers’ top lines during the past year alone.

National brands are also demonstrating strength in important private label categories. During the same period, national brand marketers gained ground in the remaining top five private label categories, increasing the revenue they generate in these categories by a combined total of more than $1.7 billion across IRI’s multi-outlet geography. The biggest win for national brands is evidenced in the vitamins category, where volume share climbed 6.9 points since 2010.

In the coming months and years, consumers will continue to look to both national brands and private label solutions to find the best value for their money. To deliver, savvy marketers from both sides will focus on one or more of the following growth strategies: deepening penetration, fracturing concentration and strengthening of price and promotion strategies.

“Private label is clearly here to stay,” adds Viamari. “For private label to prosper, it is critical for private label marketers to understand the role of their brands in relation to competing national brands. And, national and private brand marketers must step up their collaborative focus, directing their efforts to retailer/manufacturer partners that ‘best fit’ their strategic goals and objectives. This type of strategic collaborative marketing partnership will increase sales and strengthen customer loyalty by getting the right products to the right place at the right time, with a targeted value proposition.”

General Mills Eyes Processor Partners

General Mills says it has transformed its Convenience & Foodservice business and significantly improved its profitability and market share during the past five years. Officials say one strategy has been to focus on innovation in key growth channels, such as convenience stores. In fact, this focus was illustrated by the division’s recent name change from Bakeries & Foodservice to the new Convenience & Foodservice name.

General Mills says it has transformed its Convenience & Foodservice business and significantly improved its profitability and market share during the past five years. Officials say one strategy has been to focus on innovation in key growth channels, such as convenience stores. In fact, this focus was illustrated by the division’s recent name change from Bakeries & Foodservice to the new Convenience & Foodservice name.

“Seven of the 10 fastest growing categories in convenience stores are food and beverage categories,” says David Wilson, marketing manager for General Mills Convenience. Wilson says one of General Mills’ key c-store strategies is to leverage external partnerships through open innovation and the General Mills Worldwide Innovation Network (G-WIN).

“Leveraging external partnerships to help us innovate effectively and efficiently is an inherent part of what makes us successful in the c-store channel,” explains Lynn Choi Perrin, a senior scientist for General Mills. “Due to the unique business model and product distribution for the c-store channel, new product launches start relatively small in comparison to a traditional U.S. retail launch, and then grow year over year. This exponential approach to new product launches is why our division relies heavily on our external partners who are willing to scale with us over time.”

Perrin notes that nearly all of General Mills’ new product innovation specific for the convenience-store channel is facilitated with the help of outside partners. Two brand-new products, Chex Chips and Nature Valley Nut Clusters (both launching in January 2014), were fueled by open innovation. The team tapped the expertise of an outside partner company to help source the ingredients for Chex Chips, and the product is produced by a co-manufacturer who has more flexibility of scale than General Mills’ facilities.

Nature Valley Nut Clusters also demonstrate the value of external collaborations, as the format and recipe were developed in partnership with a co-manufacturer that possessed the specific expertise to bring the product more quickly to market.

“It’s critically important that we form win-win, creative partnerships to help us grow in this channel, and allow our partner companies to grow, too,” Perrin says. “Our collaborations go far beyond, ‘Can we run our product on your line?’ Instead, we look for true innovators who are willing to partner with us beyond production to build our brands and mutually benefit our businesses.”

NPD: “Boomers Most Likely to Diet”

There is a generation gap when it comes to dieting. Baby Boomers are more likely to diet than Millennials, says The NPD Group. The global consumer and market insights firm says more than a quarter of all U.S. Boomers are on a diet, while only 12% of Millennials diet.

There is a generation gap when it comes to dieting. Baby Boomers are more likely to diet than Millennials, says The NPD Group. The global consumer and market insights firm says more than a quarter of all U.S. Boomers are on a diet, while only 12% of Millennials diet.

“Millennials will diet more as they age, but the core dieters in this country are Boomers,” says Harry Balzer, chief industry analyst and author of Eating Patterns in America. “But, fewer of us are dieting. Americans are looking for other ways to define health,” says Balzer.

NPD says these trends are part of a long-term decline in dieting. Some 19% of adults report being on a diet in the last year, according to The NPD Group’s National Eating Trends Service, which examines top-of-mind dieting and nutrition, as well as actual eating and drinking habits. Dieting peaked in 1991, when nearly 30% of adults reported being on a diet during a typical two-week period. While Americans are dieting less overall, as adults age, they are more likely to be on a diet.

Even though dieting is down, 57% of adults still report that they would like to lose 20lbs.

“Dieting is not the only way to address your health these days,” says Balzer. “Avoiding foods with harmful substances and adding foods with beneficial ingredients remain an appealing way to deal with our health, rather than just dieting.”

NPD suggests that 72% of adults eat reduced fat foods; nearly 45% of adults eat foods with whole grains on a regular basis; and 24% include organic foods and beverages in their diet.

“Dieting is difficult and requires a change in habits. Eating healthy or adding good foods in your diet is much easier,” Balzer notes.